social security tax rate 2021

For 2021 the Social Security tax rate for employers and employees is 62 total 124 on the. Ministry of Labour and Vocational Training Building No 3 Russian Federation Blvd Sangkat Tuek Laak 1 Khan Tuol Kok Phnom PenhTel.

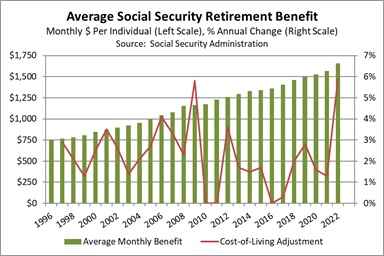

Maximum Social Security Taxes Will Increase 3 7 While Benefits Will Rise 1 3 In 2021

As a result the Trustees.

. If the total is. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

Worksheet to Determine if Benefits May Be Taxable. The rate consists of two parts. Maximum Taxable Earnings Rose To 142800.

For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple. The Federal Insurance Contributions Act FICA tax rate which is the combined Social Security tax rate of 62 and the Medicare tax rate of 145 will be 765 for 2020 up.

In 2020 employees were required to pay a 62 Social Security tax on income of up to 137700. 62 of each employees first. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

As of 2021 a single rate of 124 is. Social Security Payroll Tax for 2021. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021.

B One-half of amount on line A. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The change to the taxable maximum called the contribution and benefit.

A Amount of Social Security or Railroad Retirement Benefits. By joseph June 15 2022. Tax brackets for income earned in 2022.

What is my taxable income on Social security benefits for 2021 total benefits of 2793000. Tax rates are checked regularly in 2021 however please confirm tax rates with the countrys tax authority before using them to make business. The self-employment tax rate is 153.

The employees Social Security payroll tax rate for 2021 January 1 through December 31 2021 is 62 of the first 142800 of wages salaries etc. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. Social Security functions much like a flat tax.

In 2022 the Social Security tax limit is 147000 up. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. How Much Of My Social Security Is Taxable In 2021.

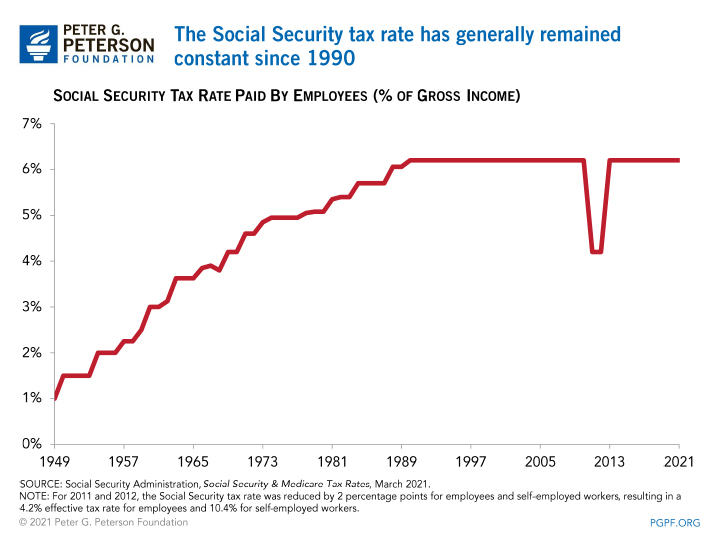

The social security tax has been in place since the 1930s and has been increased several times over the years. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security.

The SSA has also released a fact sheet summarizing the changes for 2021. The tax rate for Social Security benefits varies based on a number of factors aside from just age. The most recent increase was in 1990 when the tax rate was.

Between 25000 and 34000 you may have to pay income tax on. And the household income of recipients is the main deciding factor in taxation. Any earnings above that amount.

Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employees share of Social Security taxes. 71 years old - Answered by a verified Tax Professional.

Publication 915 2021 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

Federal Insurance Contributions Act Wikipedia

Tax Systems Of Scandinavian Countries Tax Foundation

Asset Allocation Weekly The Inflation Adjustment For Social Security Benefits In 2022 October 22 2021 Confluence Investment Management

Maximum Taxable Income Amount For Social Security Tax Fica

Social Security Benefits Increase In 2021 Integrated Tax Services

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

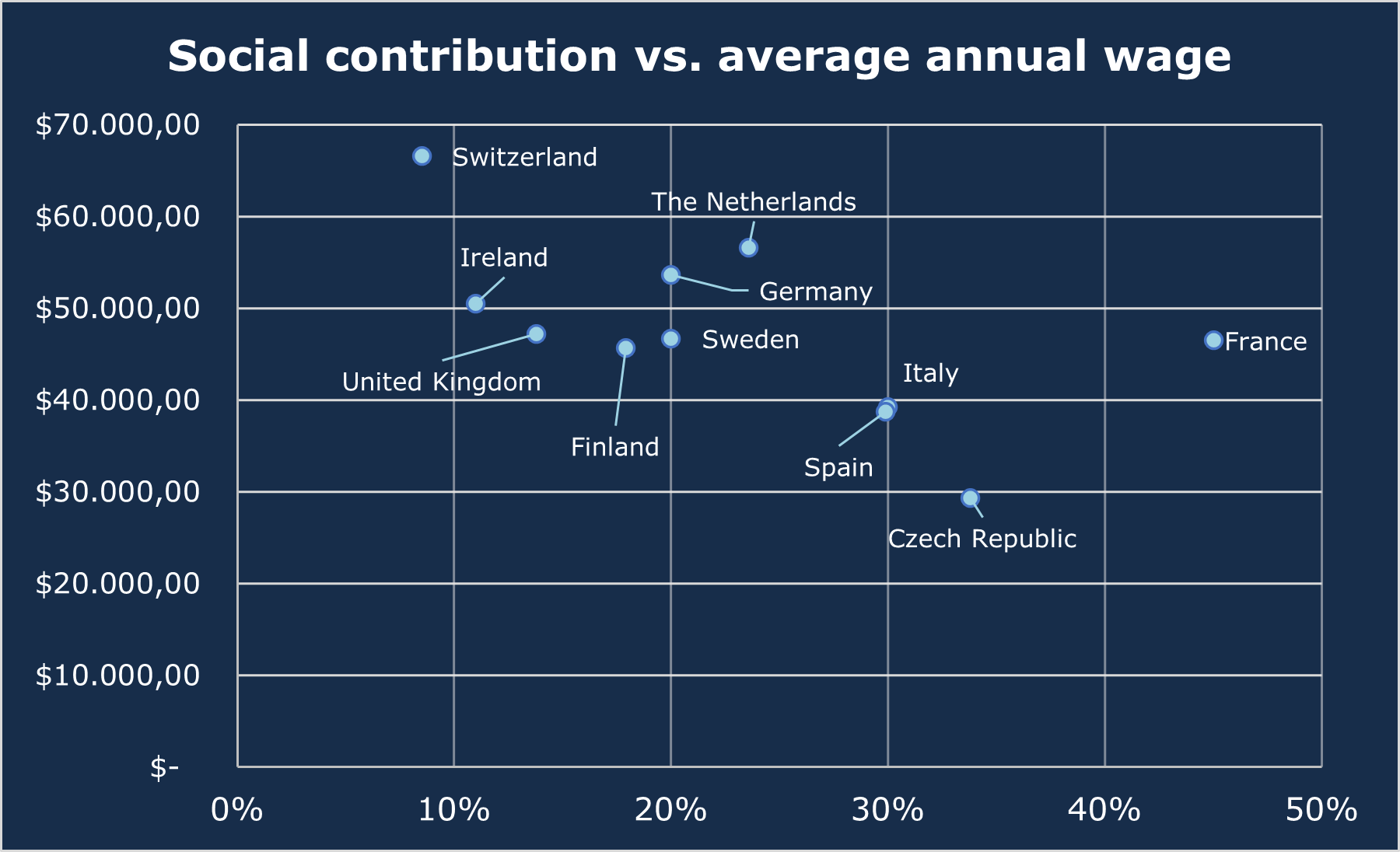

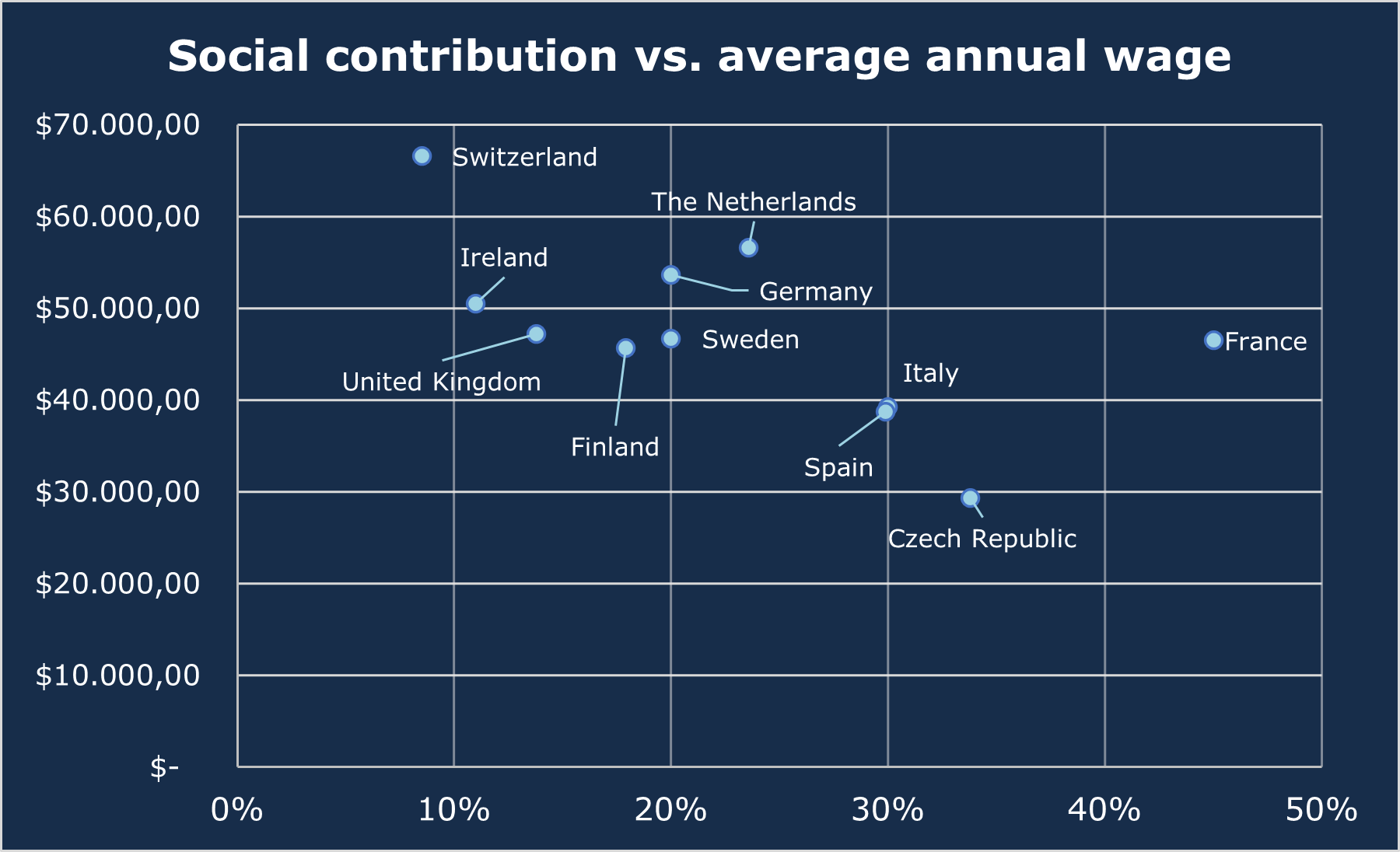

Social Security Tax Rates For Employers In Europe 2021

The Taxation Of Social Security Benefits Congressional Budget Office

Social Security Tax Cap 2021 Here S How Much You Will Pay

Payroll Taxes What Are They And What Do They Fund

Overview Of Fica Tax Medicare Social Security

Did Reagan Impose An Income Tax On Social Security The Meme Policeman

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons