inheritance tax rate in michigan

Inheritance tax is levied by state law on an heirs right to receive property from an estate. Inheritance Tax Rate In Michigan.

Michigan Inheritance Laws What You Should Know

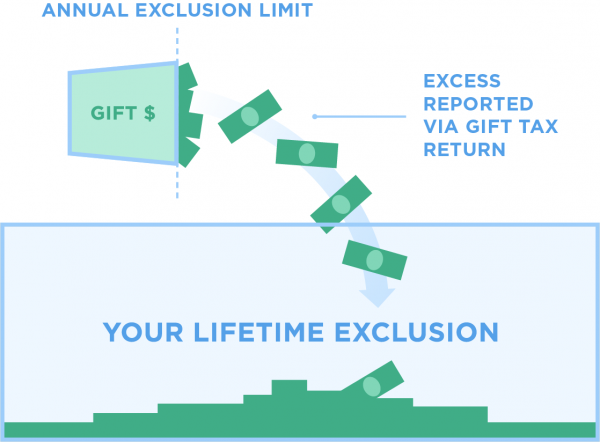

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from.

. If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

To have been a resident of canada throughout 2020 or 2022. Only a handful of states still impose inheritance taxes. The top estate tax rate is 16 percent exemption.

There is no federal inheritance tax but there is a federal estate tax. Only a handful of states still impose inheritance taxes. The State of Michigan does not impose an.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. What is an Inheritance Tax. No estate tax or inheritance tax.

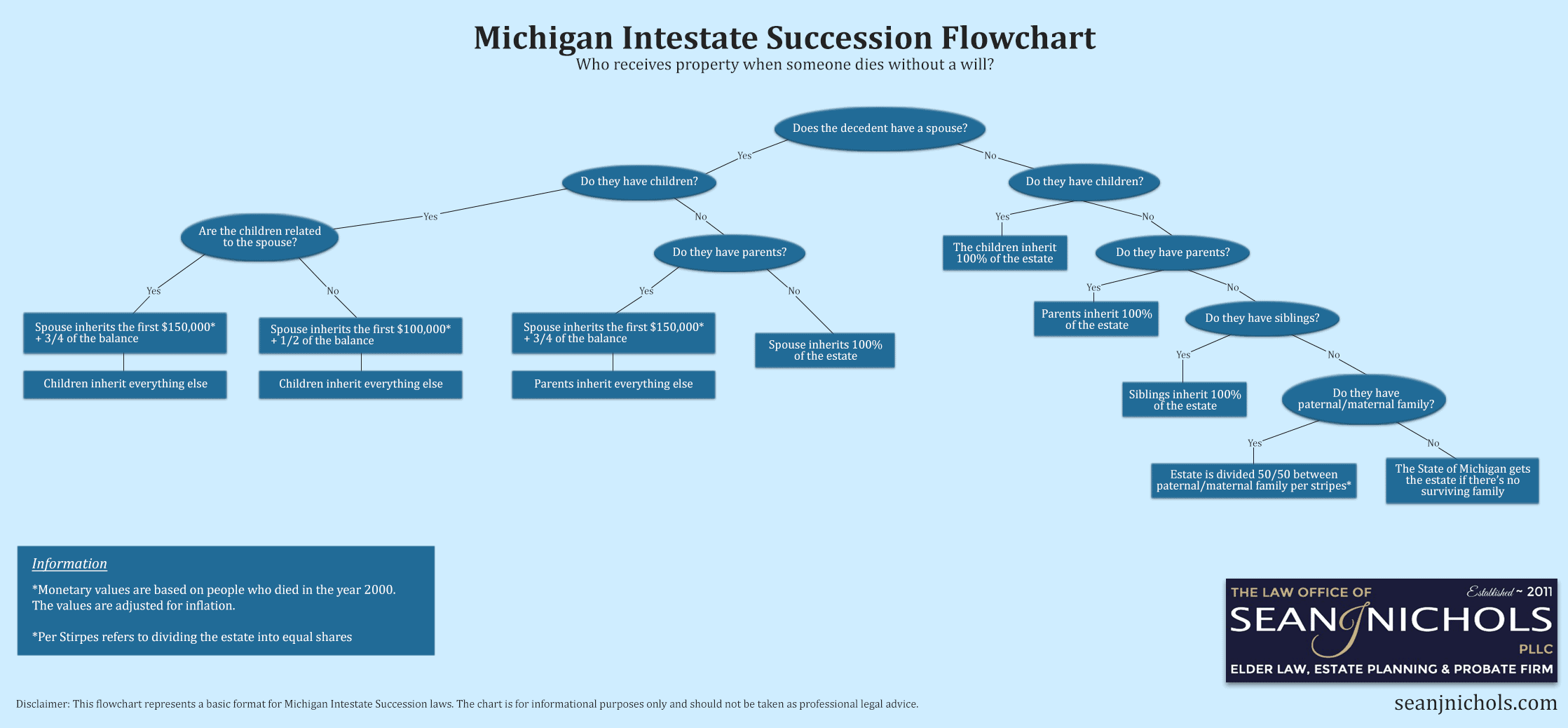

There is no federal inheritance tax but there is a federal estate tax. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who died on or before September 30 1993. When a person dies in Michigan all of the money and property they own and the debts they owe at death are part of their estate.

The estate tax is a tax on a persons assets after death. Inheritance tax is levied by state law on an heirs right to receive property from an estate. Michigan estate law is a compilation of the.

Only a handful of states still impose inheritance taxes. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets. Michigans estate tax is not operative as a result of changes in federal law.

The State of Michigan does not. Federal Death Tax After much uncertainty Congress stabilized the Federal Estate Tax also. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

For most people there is no concern about Michigan estate or death taxes. Inheritance tax is levied by state law on an heirs right to receive property from an estate. To have been a resident of canada throughout 2020 or 2022.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. There is no federal inheritance tax but there is a federal estate tax. The State of Michigan does not.

Inheritance Tax Rate In Michigan. The top estate tax rate is 16 percent exemption threshold.

How Do State And Local Property Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

Michigan Health Legal And End Of Life Resources Everplans

Michigan Inheritance Laws What You Should Know Smartasset

Michigan Probate Laws What You Need To Know

Michigan S Low Income Tax Rate Means No Problem With New Deduction Limits Politically Speaking

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

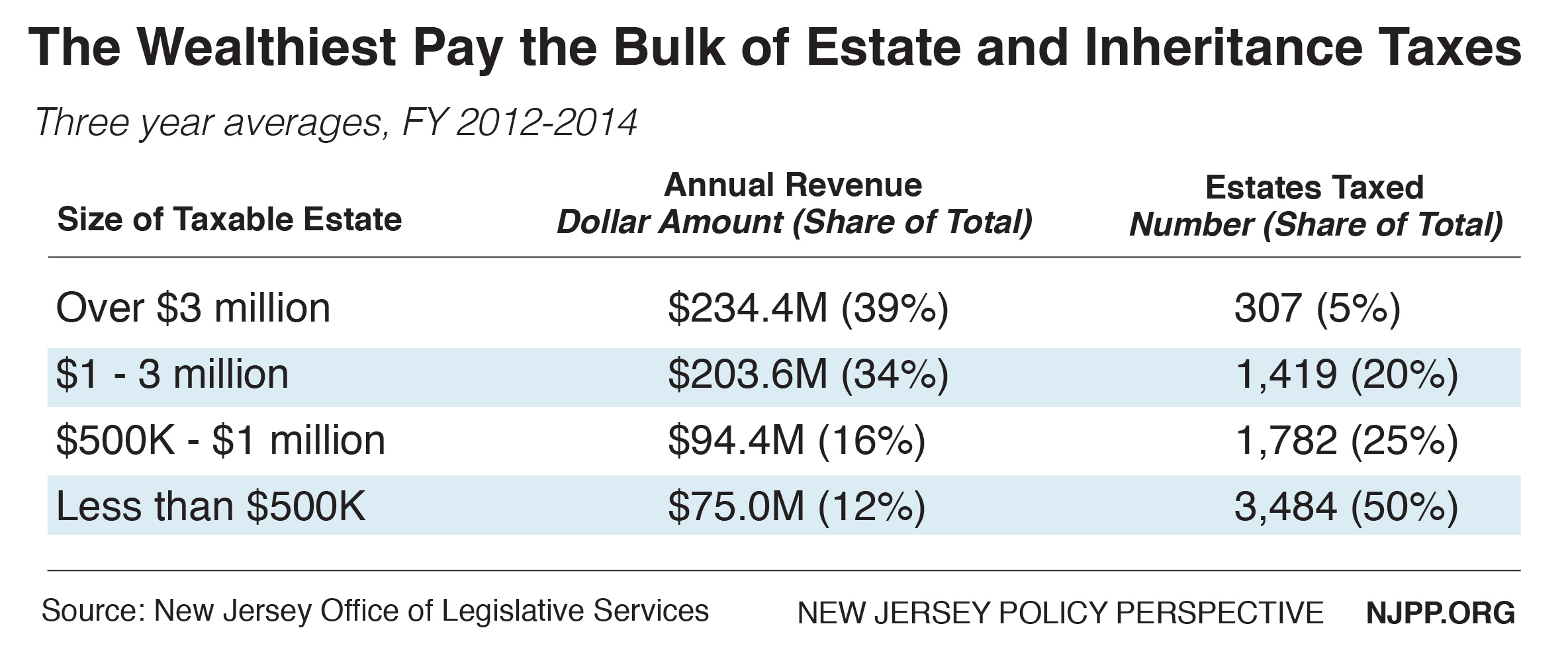

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

State Corporate Income Tax Rates And Brackets Tax Foundation

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Taxation In The United States Wikipedia

Estate And Inheritance Taxes By State In 2021 The Motley Fool

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation