does north carolina charge sales tax on food

NORTH CAROLINA 475 4 NORTH DAKOTA 5 OHIO 575 OKLAHOMA 45 OREGON none -- -- --. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Is Food Taxable In North Carolina Taxjar

The transit and other local rates do not apply to qualifying.

. But North Carolina does charge the 2 or 225 percent local sales tax on qualifying food exempting food purchases only from the statewide sales tax and the transit tax. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

The North Carolina state sales tax. Indicates exempt from tax blank indicates subject to general sales tax rate. 31 rows The state sales tax rate in North Carolina is 4750.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Overview of Sales and Use Taxes.

North Carolina has recent rate changes Fri. Candy however is generally taxed at the full combined sales tax rate. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent.

Prescription Medicine groceries and gasoline. Only five states dont impose a sales tax but many exempt food drugs and even clothing to make up for it. Goods that are subject to sales tax in North Carolina include physical property like furniture home appliances and motor vehicles.

Some examples of items that exempt from North. North Carolina doesnt collect sales tax on purchases of most prescription drugs. This page describes the taxability of.

Sales and Use Tax. Three states Alabama Mississippi and South Dakota continue to apply their sales tax fully to food purchased for home consumption without providing any offset for low-. With local taxes the total sales tax rate is between 6750 and 7500.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. No matter if you are based in North Carolina or not based there but have sales tax nexus there charge sales tax at the rate of your buyers ship to location. Who Should Register for Sales and Use Tax.

Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

.png)

States Sales Taxes On Software Tax Foundation

Sales And Use Tax What Is The Difference Between Sales Use Tax

States Without Sales Tax Article

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Ohio Sales Tax For Restaurants Sales Tax Helper

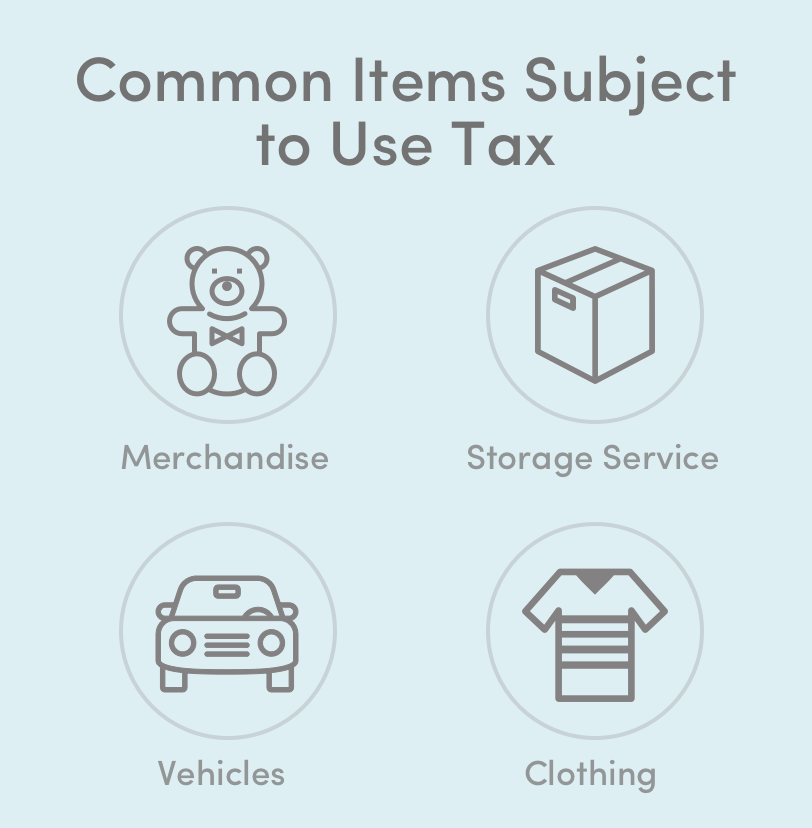

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Is Food Taxable In North Carolina Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Woocommerce Sales Tax In The Us How To Automate Calculations

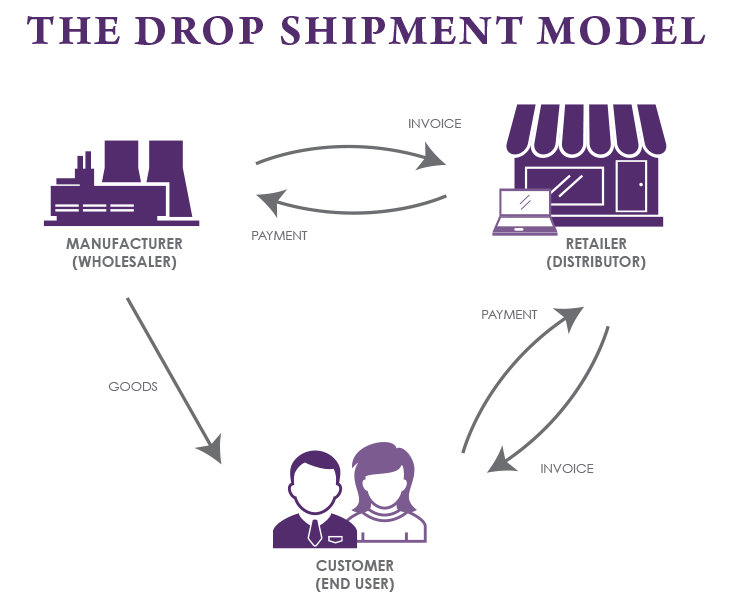

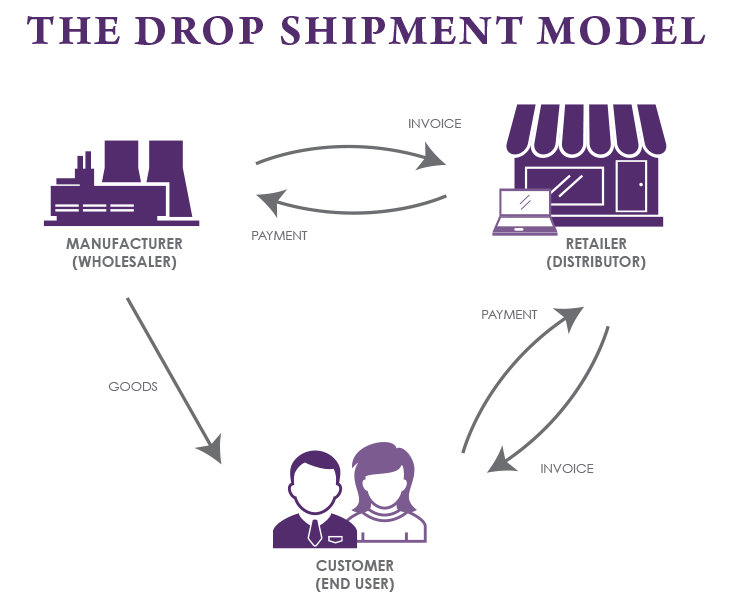

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

How To Register For A Sales Tax Permit Taxjar

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar